This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

As countries across the region scramble to make sure they have enough coal, gas and fuel oil to keep the lights on, Russian energy being shunned by the West is looking increasingly attractive.

What began as a push from the Kremlin to fund its invasion of Ukraine has now turned into a pull from Asian economies anxious about making sure their power generators are supplied with enough fuel in what could be the hottest year on record.

“The worst place to be right now amid these searing temperatures is South Asia, especially poorer nations like Pakistan or Bangladesh,” said John Driscoll, director of JTD Energy Services Pte in Singapore.

“When you can’t even take care of your people’s basic needs, it’s very hard to care too much about international affairs.”

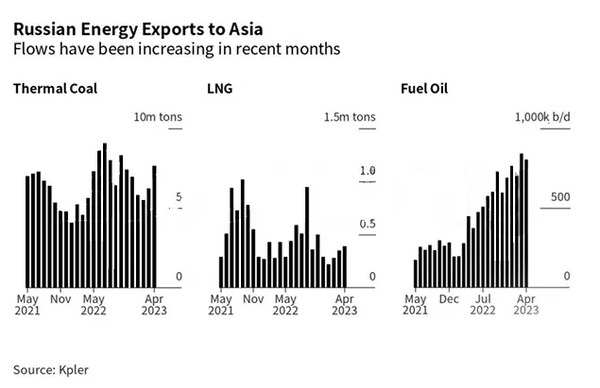

Russian exports to Asia of thermal coal and natural gas, the two fuels most often used for electricity generation, have grown markedly this year, figures from data intelligence firm Kpler show.

Coal volumes jumped sharply to 7.46 million tons in April, about a third higher than a year earlier. Shipments of liquefied natural gas to Asia have also been growing in recent months after prices retreated from record highs that had made the fuel unaffordable for many poorer nations.

Meanwhile, Asian imports of Russian fuel oil, a dirtier and cheaper alternative for power generation, had the two highest months on record in March and April, according to Kpler.

The impetus for the region to buy more Russian energy is likely to increase due to an emerging El Niño weather pattern, which has already sent the mercury soaring in parts of the region. Vietnam’s prime minister has warned of power shortages this month, while Myanmar is struggling with worsening blackouts.

In India, heat-driven power demand will likely be satisfied mostly by coal, said Aniket Autade, power fundamentals analyst for Rystad Energy.

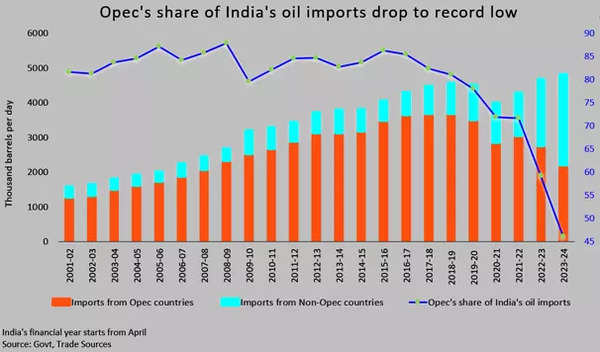

China and India — the most enthusiastic buyers of discounted Russian oil — are also purchasing the most coal, gas and fuel oil. They took more than two-thirds of Russian coal sent to Asia last month, according to Bloomberg calculations based on Kpler data. South Korea, however, scooped up 15% of the shipments, while Vietnam, Malaysia and Sri Lanka have also emerged as significant buyers.

For fuel oil, China and India were again the biggest buyers from Russia, with Saudi Arabia and the United Arab Emirates also major importers, the Kpler figures show.

Bangladesh, Pakistan and Sri Lanka will probably import more Russian fuel oil for power generation, according to Emma Li, an analyst with Vortexa. The Middle East has also recently increased its imports, and that’s likely to continue over the summer, she said.

Pakistan said this month it was keen to pay for Russian oil imports with the Chinese yuan. The country has has placed an order for a single cargo of the crude, but is keen for a long-term deal to buy it in Chinese currency, its power minister said.

Even Japan, a close ally of the US and therefore reluctant to increase imports from Russia, might expand buying within contractual limits, according to Chris Wilkinson, senior analyst for renewables at Rystad.

“Japan may consider purchasing more LNG from Russia under its existing long-term contracts, as it is more cost-effective than buying on the spot market,” he said.

For JTD Energy’s Driscoll, the increasing purchases of Russian energy by many Asian countries highlights both the White House’s declining clout and the perilous situation many nations find themselves in.

“[They] are asking themselves: would I rather risk falling afoul of the US or forgo steep discounts on energy?,” he said. “When there’s a good deal on the table, how can poorer nations afford to say no?”

Watch EAM Jaishankar responds to EU's Concerns on import of Russian crude by India, cites EU council regulationsRead More

Africana55 Radio

Africana55 Radio