This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Getty Images

Getty ImagesDonald Trump has imposed new tariffs on imports from Mexico and Canada, and has doubled the levy recently put on Chinese goods.

The president sees tariffs, which are border taxes on imports, as a way to protect US manufacturing and correct trade imbalances.

His latest round of tariffs follows earlier ones the US levied on all steel and aluminium imports.

Canada and China have already retaliated with tariffs of their own against US goods, sparking fears of a global trade war and higher prices.

What are tariffs and how do they work?

Tariffs are taxes charged on goods imported from other countries.

The companies that bring the foreign goods into the country pay the tax to the government.

Typically, tariffs are a percentage of a product's value. Imposing a 20% tariff on Chinese goods means a product worth $10 would have an additional $2 charge applied to it.

Firms may choose to pass on some or all of the cost of tariffs to customers.

The US has typically charged lower tariffs on goods than other countries, which means his reciprocal plan could lead to a sudden and sharp increase in the tax rates - and to the prices people pay at checkout.

Why is Trump using tariffs?

Tariffs are a central part of Trump's economic plans. He says tariffs will boost US manufacturing and protect jobs, as well as raising tax revenue and growing the economy.

Goods from China, Mexico and Canada accounted for more than 40% of imports into the US in 2024.

When he first announced plans for new tariffs, the White House said the president was "taking bold action to hold [the three countries] accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country".

Fentanyl is linked to tens of thousands of overdose deaths in the US each year.

The Trump administration says the chemicals come from China, while Mexican gangs supply it illegally and run fentanyl labs in Canada.

Canadian Prime Minister Justin Trudeau said his country was responsible for less than 1% of fentanyl entering the US, most of which comes from Mexico.

What is happening with tariffs against China?

A 10% charge on all goods imported from China started on 4 February.

Trump later said shipments worth less than $800 (£645) would be exempt.

On 10 February, China responded with its own tariffs, including a 10-15% tax on some US agricultural goods.

Beijing has also targeted various US aviation, defence and tech firms by adding them to an "unreliable entity list" and imposing export controls.

The 10% levy doubled to 20% on 4 March.

China urged the US to return to dialogue with Beijing as soon as possible.

"If the United States... persists in waging a tariff war, a trade war, or any other kind of war, the Chinese side will fight them to the bitter end," foreign ministry spokesman Lin Jian warned.

What is happening with tariffs against Canada?

The newest tariffs enacted on 4 March are 25% against both US neighbours, Canada and Mexico.

They were originally due to begin on 4 February but delayed a month.

Canadian energy imports face a 10% tariff.

Trump said the delay would let the US see "whether or not a final economic deal with Canada" could be reached.

In retaliation on 4 March, Prime Minister Justin Trudeau said his country would immediately target C$30bn worth of products, and the remaining C$125bn over 21 days.

Any fresh duties Canada imposes will be in place for as long as the US tariffs are, he added.

Canada may also restrict US access to its energy. The country is the top oil supplier to the US and also provides some electricity to 30% of the states.

What is happening with tariffs against Mexico?

Mexico also delayed retaliatory tariffs on US goods after the initial US pause.

President Claudia Sheinbaum agreed to send 10,000 members of the National Guard to the US-Mexican border to "prevent the trafficking of drugs, in particular fentanyl".

She said the US had in turn agreed to increase measures to prevent the trafficking of high-powered American weapons into Mexico.

Speaking after Trump's tariffs came into force on 4 March, Sheinbaum said the US's decision to go ahead with 25% levies had "no justification" - adding that Mexico wanted respect from its northern neighbour.

Mexico will impose "tariff and non-tariff measures" in response, she added, and promised to set out further details on 9 March.

How will the steel and aluminum tariffs work?

Canada also provided more than 50% of the aluminium imported into the US in 2024.

American companies that use steel and aluminium to make products have warned the tariffs could push their prices up.

The Canadian government said the tariffs were "totally unjustified" and vowed swift retaliation.

Trump previously announced tariffs of 25% on steel and 15% on aluminium in 2018, during his first term as president. However, he later negotiated exceptions for many countries including Australia, Canada and Mexico.

Despite the exemptions, tariffs raised the average price of steel and aluminium in the US by 2.4% and 1.6% respectively, according to the US International Trade Commission.

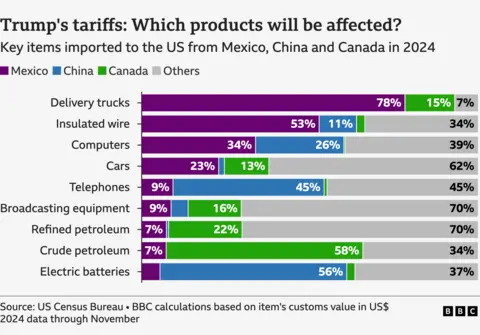

Which products will be affected and will prices increase?

All goods from China worth more than $800 are covered by the tariff.

All steel imports from around the world face a 25% tax.

Mexican and Canadian goods will also be subject to a 25% levy. A 10% tariff has been added to Canadian energy exports.

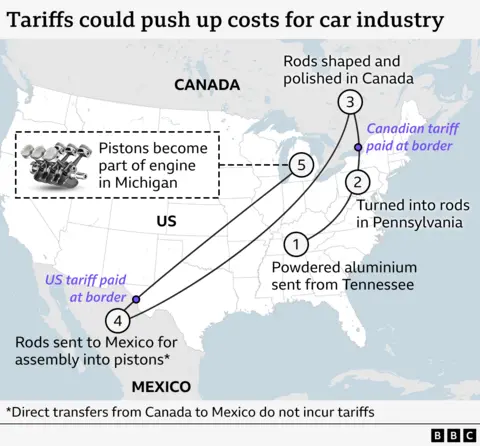

Car manufacturing could be hit extremely hard. Vehicle parts cross the US, Mexican and Canadian borders multiple times before a vehicle is completely assembled.

The average US car price could increase by $3,000 because of the import taxes, financial analyst TD Economics suggested.

Goods from Mexico that could be affected include fruit, vegetables, spirits and beer.

In addition to steel, Canadian goods such as timber, grains and potatoes are also likely to get more expensive.

An increase in the cost of Canadian oil and electricity could push up prices across the board.

US tariffs on imported washing machines between 2018 and 2023 increased the price of laundry equipment by 34%, according to official statistics. Prices fell once the tariffs expired.

The Federal Reserve of Atlanta has estimated that the Mexico and Canada tariffs, combined with adding another 10% tariff on Chinese goods, could raise prices on everyday purchases by 0.81% to 1.63%.

Some experts suggest that Trump's new round of tariffs could prompt a wider trade war that could put prices up more generally.

Capitol Economics said the annual rate of US inflation could increase from 2.9% to as high as 4%.

Will the UK and Europe have to pay tariffs?

Trump previously told the BBC the UK was "out of line", but suggested a solution could be "worked out".

The UK exports pharmaceutical products, cars and scientific instruments to the US.

Business Secretary Jonathan Reynolds said the UK should be excluded from tariffs because it buys more from the US than it sells there.

Speaking in Parliament after the announcement of the steel and aluminium tariffs, Trade Minister Douglas Alexander promised a "cool and clear-headed" response.

During his 26 February cabinet meeting, Trump said he would announce sanctions on EU goods "very soon".

"It'll be 25% generally speaking and that will be on cars and all other things," he added.

The US had a trade deficit of $213bn with the EU in 2024 - something Trump has previously described as "an atrocity".

In response, the European Commission said it would react "firmly and immediately against unjustified tariffs".

US companies Harley Davidson and Jack Daniel's have previously faced EU tariffs.

Africana55 Radio

Africana55 Radio